Cash management account MVP Design

Feb 2023 -Apr 2023 @Good Finance

A pioneering product integrates cash management account, providing customers with a seamless experience to trade and manage cash flow. Although it currently provides only basic functions such as tracking account balances, trading history, and facilitating withdrawals, the minimum viable product (MVP) aims to break the limitations of traditional settlement accounts and offer more advanced financial services in the future.

PLATFORM

Web View in Mobile App

REGION

Taiwan

WHAT I DID

Design user interface

Usability testing and iteration

Facilitate the discussions between PM, Dev and other stakeholders.

Write product requirement documents (PRDs)

ACHIEVEMENTS

Validated the feasibility of the cash management account, ensuring the accurate display of individual account and billing information.

Designed an intuitive account balance display, balancing backend feasibility with user-friendly presentation.

Expanded the application of the official website’s design components to enhance consistency across platforms.

Backgound

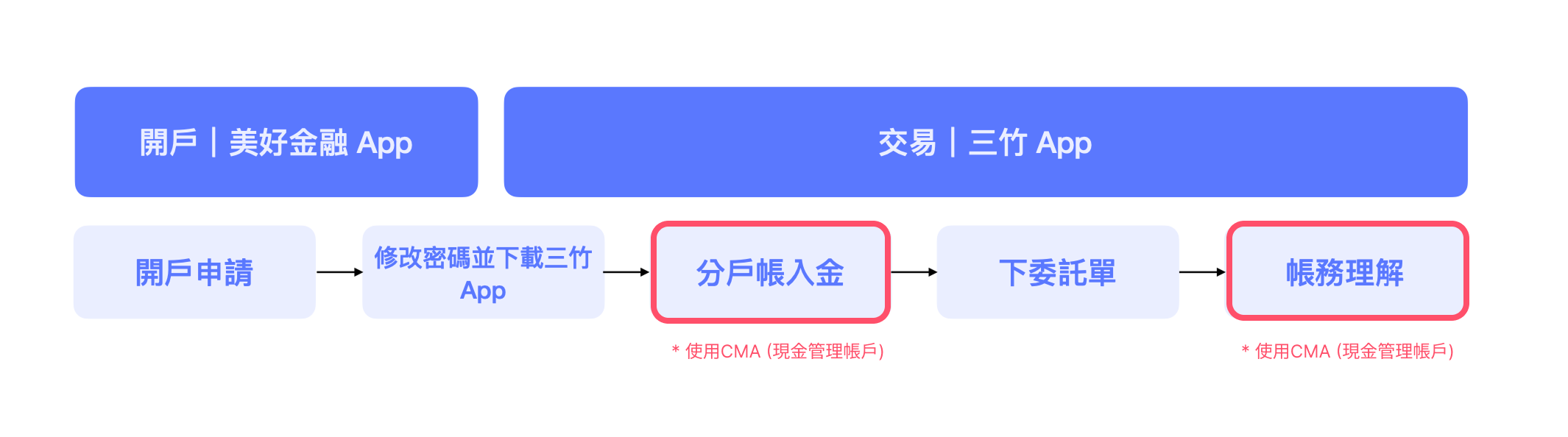

To simplify the process of opening a securities settlement account and leverage the T+0 fund reservation system to reduce settlement default risks, GoodFinance introduced the Cash Management Account.

To accelerate the product launch and testify CMA integration, the front-end was implemented as an in-app browser, seamlessly integrating cash flow management within the existing securities trading app. Users could deposit, withdraw, and view their account balances, while the back-end leveraged the company's legacy COBOL system for execution. From initial design to development-ready testing, the entire process took less than two months.

Results

From a design perspective, this MVP focused on core functionalities—account overview, deposits, withdrawals, and statement downloads. However, the greatest challenge lay in defining financial data structures and ensuring users could effortlessly understand their account status. Key UX considerations included:

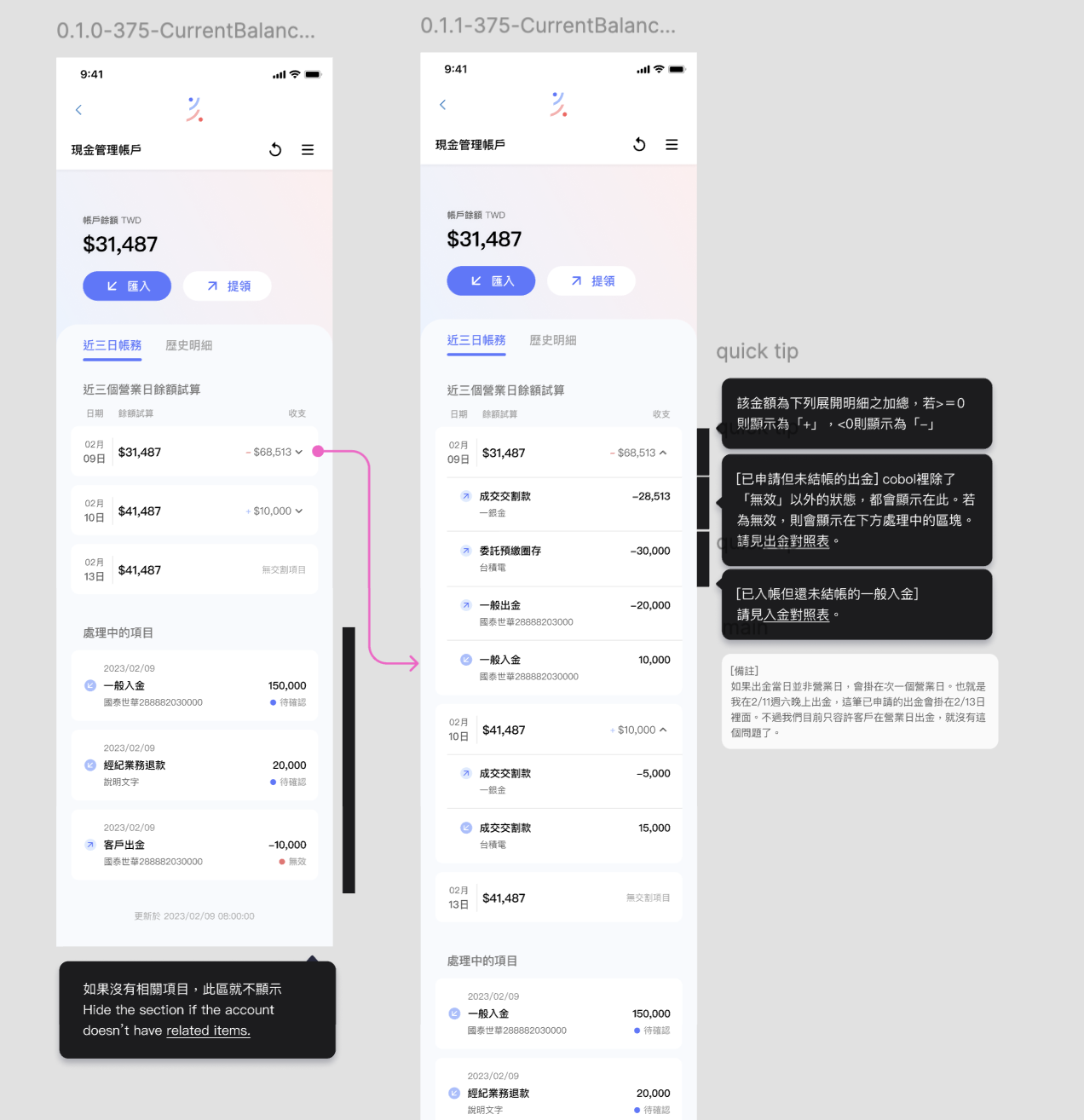

Display Three-day balance and processing transaction

Ensured users could accurately understand how account balances are calculated by presenting today's available balance, projected balances for the next two days, and their correlation with T+2 settlement transactions.

Display balance of T+0 reserved funds transaction

Compared to T+2 settlements, T+0 reserved fund transactions are more complex. In addition to the projected balances for the next two days, users need to interpret purchasing power, withdrawable funds, and key financial terms. To enhance clarity, we added tooltips explaining the definitions of these numbers.

To ensure internal developers and QA teams fully understood these calculations, I created explanatory slides and visual diagrams, helping them grasp the meaning behind these figures. (View the slides)

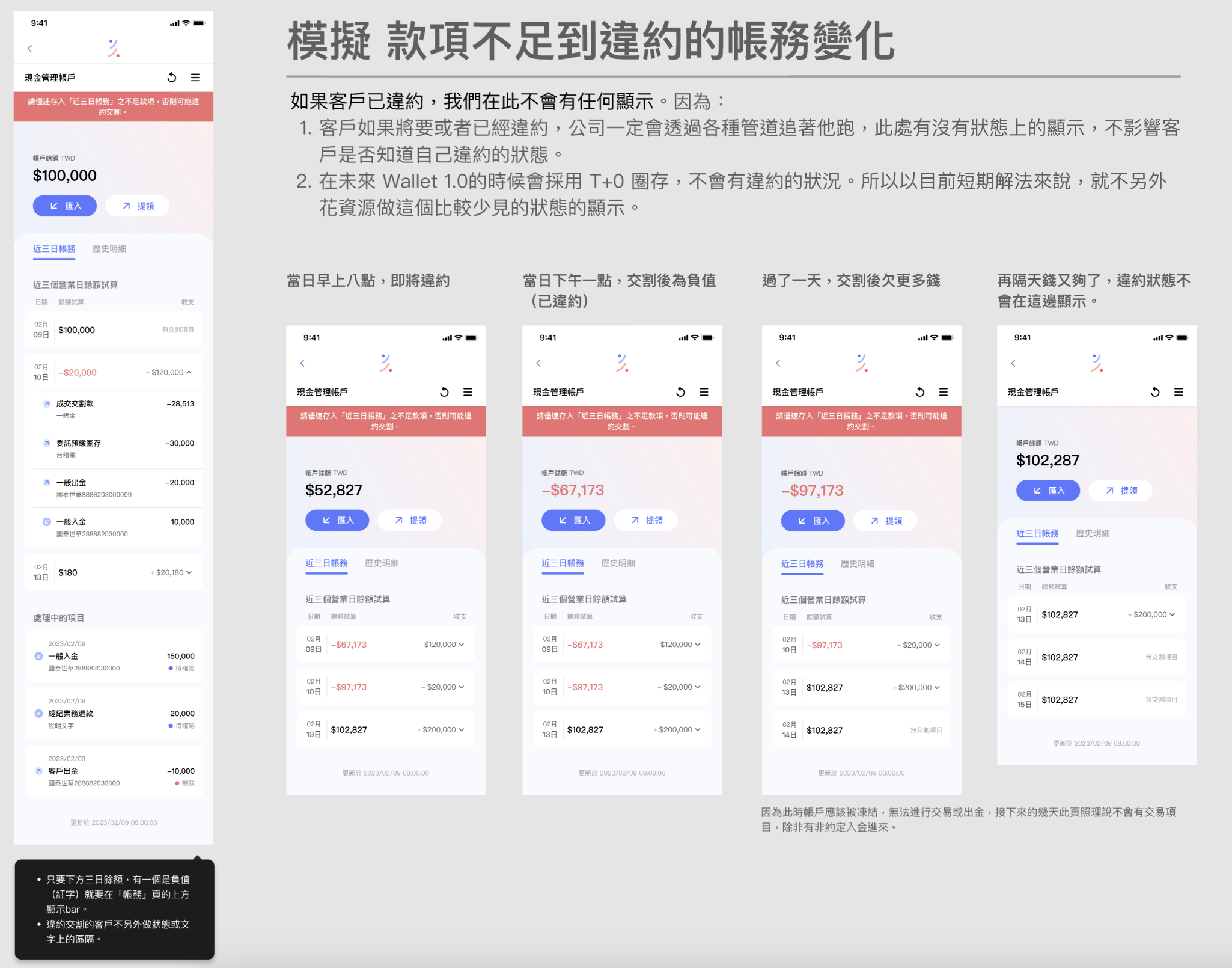

Insufficient balance warnings

Settlement failures must be avoided at all costs. When a balance shortage is detected within the next three days, users receive a prominent warning prompting them to deposit funds into their account to prevent issues with upcoming deductions.

To ensure clarity, I collaborated with user researchers and conducted two rounds of usability testing with real users. These tests validated that financial data was presented in a clear, intuitive manner, minimizing confusion and enhancing user trust. Additionally, I ensured a seamless integration of the CMA features and workflows within the existing securities trading app.

Patial screenshot of testing prototype

Summary of the issues and fixed plan